✍️#9: PUMA FAST-R NITRO ELITE 3 and the TIPPING POINT of Marginal Gains Marketing.

Puma made the MOMENT out of the Boston Marathon with the release of their newest shoe, but what long term effects should we expect?

The Kickoff: NIKE’s 4% Debut

Let’s rewind briefly to 2017 — NIKE released the 4%. Previously, shoes for marathon racing focused either on weight-saving measures or maximizing comfort for the long haul. NIKE changed the game forever with the release of the Vaporfly 4%, which was aptly named for the percentage of efficiency improvement gained by wearing these shoes. Backed by a cornucopia of data and testing, the 4% was developed along with several ancillary products to focus on FASTER. They landed on a recipe of super-light ZoomX foam and a tuned carbon plate to save weight, supply comfort, and propel the runner forward.

If you remember as well, the project enabled by the 4% was an effort to create the perfect conditions to break 2 hours in the marathon. The lore is deep and the impact will be forever.

Note: The original shoe earned the name 4% because thats what the efficiency tests showed benefit when tested on 18 subjects who were selected for the project. This is not a ubiquitous number to be applied to all runners. Things like running economy, footstrike, ground contact time, force, etc. all contribute to the potential for a runner to benefit. This will be important later.

Chapter 2: Other Brands Enter the Chat and NIKE debuts the Next% and Alphafly.

A frenzy ensued. Brands rushed to reverse engineer solutions as quickly as possible to keep up and the learning curve was steep. Brands quickly found up the sheer amount of work required to chef up the right recipe for the runner. Some brands bet on foam development. Some brands bet on the carbon plate. Simply put: it wasn’t as easy as cramming PEBAX foam under foot with a carbon plate and calling it a day. The durometer of the foam, the shape and thickness of the plate, the stability ALL MATTERED. Regardless, it took brands several iterations to get it right and publications like Runner’s World, Doctors of Running, etc. and organizations like Heeluxe helped steer the public in the right direction with science-backed results to show who reigned supreme in the battle for race day domination.

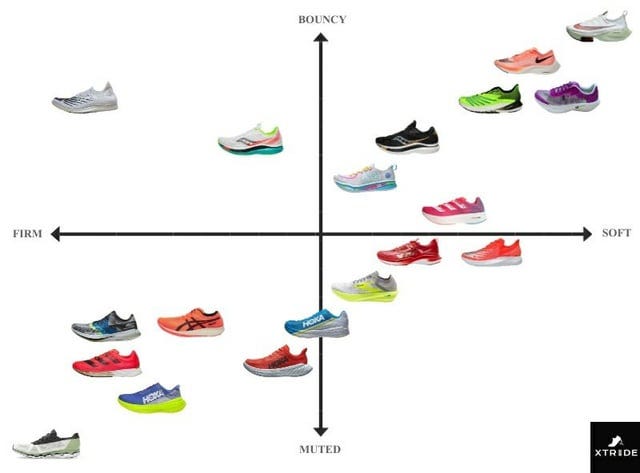

We are now fortunate enough to live in QUITE a golden era of carbon plated running. So much so that there multiple models at varying price-points and we now live in an era of PREFERENCE within the carbon world. Runner’s can now find a shoe with different carbon stabilizers like rods or wings to increase responsiveness and stability, or they can choose from various foam blends for a more sustainable and durable shoe, or they can choose amongst various heel-toe-drops. All-the-while, NIKE kept their foot on the gas releasing their future improvements on the 4% — namely, the NEXT% (2-4) and the ALPHAFLY(1-3).

PUMA’s Boston Marathon Launch

In April of 2025 during Boston Marathon Weekend, PUMA revealed their new darling: The PUMA FAST-R NITRO ELITE 3.

PUMA opened their carbon account with the Deviate Nitro series and have since produced several versions and then produced their concept car “the FASTROID,” which purposely did not abide by the rules of World Athletics for use in competition. The middle ground blending these creations became the FAST-R Nitro Elite Series. And there was no better stage than the Boston Marathon to release their third iteration.

Their playbook for the weekend seemed pretty standard and included the following elements:

getting the shoe on pro athletes (and hopefully on the podium as a result) in the BAA Mile, BAA 5k, and Marathon — giving PUMA three opportunities to validate the speed/prowess of the shoe in comparison to its competitors in a variety of events.

a pop-up for runners/fans to engage with the development of the shoe, its storytelling opportunities, and partake in community events like a shakeout.

an unsanctioned race on the streets of Boston to build in an opportunity for runners/fans to test the shoe to its limits and demonstrate its speed at a more “democratic and accessible” pace range.

Where they differed:

Project 3 — a few months back, PUMA opened a program for Boston Marathon runners to apply to in order to have a unique opportunity to race in PUMA gear, test product, and potentially win cash bonuses for PRs — in a way to replicate the pro experience. PUMA selected their applicants on a pseudo-merit basis to prove out their thesis that we now know was based on this shoe. On Marathon Monday, PUMA unleashed a small army of orange-clad racers in their new shoe, all of who are chasing a PR in their new shoe.

Releasing Independent Research — like many other brands, lab testing is brought into the equation to validate their thesis of making a faster shoe. Some do so in their own labs, while others require the use of independent research labs like Heeluxe, or in this case, UMASS Amherst. In their press release, PUMA published the research case with UMASS to shoe their findings.

Marginal Gains Era

First and foremost, a huge congrats to PUMA on making groundbreaking innovation. As the study states, the lab typically finds 1-2% improvement in other super shoes they test independently, but PUMA’s newest innovation saw a range between 3.15 - 3.62% improvement. According to the article, PUMA created an average data set for runners in a specific range of speeds, which informed virtual 3D modeling of shoe and this allowed them to digitally prototype deeply instead of relying on human testing for every datapoint. Although they said that the tester who had the worst results still saw a 1% improvement, perhaps the same caveat still exists here as it did for the 4% — this may be the solution for some, but not all because of where the data set was pulled from and who ultimately tested within the UMASS lab environment.

REGARDLESS, PUMA is taking a well-deserved victory lap to disrupt other brands on the basis of research. It seems likely that we may see a sudden push for more transparency as a differentiator as a response. Think back to the future development of NIKE’s racing line (Vaporfly and Alphafly): the percentage points were dropped from the vernacular. We graduated to using the term Next% to signify the “continued development,” and it was also a great way to decrease the expectation of 4% improvement each time they improved the silhouette. This left the niche running community on Reddit fend for themselves in testing these shoes independently for efficiency and for the average consumer relying on brand experience and anecdotal accounts of wearing them. Perhaps this is the shot across the bow for the big brands to show the receipts again!

If we see a push for transparency around these marginal gains, there are a few critiques/observations:

Will it make a difference to the consumer? While a purist in the running space may be wowed by the research and position, time will truly tell if we see a shift in the market in the direction of PUMA. It would be interesting as well to see if this ultimately brings more people into PUMA’s ecosystem beyond the race day offering. Will they buy trainers and apparel even if they now respect the footwear tech?

Will there be increased emphasis on independent testing? While several large brands have the ability to test and develop in house, will a transparency-bias of brands sharing their findings influence the consumer to want additional credibility provided by a third-party lab like Heeluxe or an institution like UMASS?

What is the tipping point? Like most marketing moments, there is a threshold of saturation until the message means nothing anymore. Sure, brands can boast their marginal gains of 1-2% (heck! even 4-5%) over other brands, but at some point, brands may blunt the message steeped purely in data. One may say that as long as qualification times continue to get more competitive that percentage differences matter. I hear that — but think about if 15 shoe brands simultaneously state that they are a 1% better than each other. We may get fatigued by fact-checking when the study was done, which shoes were compared, the price, the durability, who was the test subject, etc. All of these factors can erode the once-pure bastion of value. In other words, PUMA is perfectly timed for this positioning and it will take a similar JUMP to justify a similar victory lap.

TLDR: 1) This shoe development is wild! 2) I think brands will try to copy the study and communication, but there will be a tipping point where the data will cease to matter again.

Like what you’re reading? Buy me an NA Beer below to keep me fueled up!

I think that the group of runners using science to hack their BQ times is small but so loud, so the metrics side of things is going nowhere. Very linked to the carbs/hr things with nutrition, sleep via wearables, etc etc etc. This is what so many people want to spend their time and money on, so the grindset narrative will remain.

Great read Drew! I don't really see a huge shift in brands to "prove" the efficiency of their shoes, but do believe those who put the extra effort to do it, whether through independent research or even internally, will be rewarded. I can see the shoe tech creating similar dynamics to age group triathletes/ ironman participants: they'll spend any amount of money to own the best product they can afford. If Puma has the best reputation for that now (I think Nike and adidas are losing their throne) people will lean into it.